In the realm of professional growth, there comes a pivotal moment for many individuals when the…

Funding Options for Women Entrepreneurs

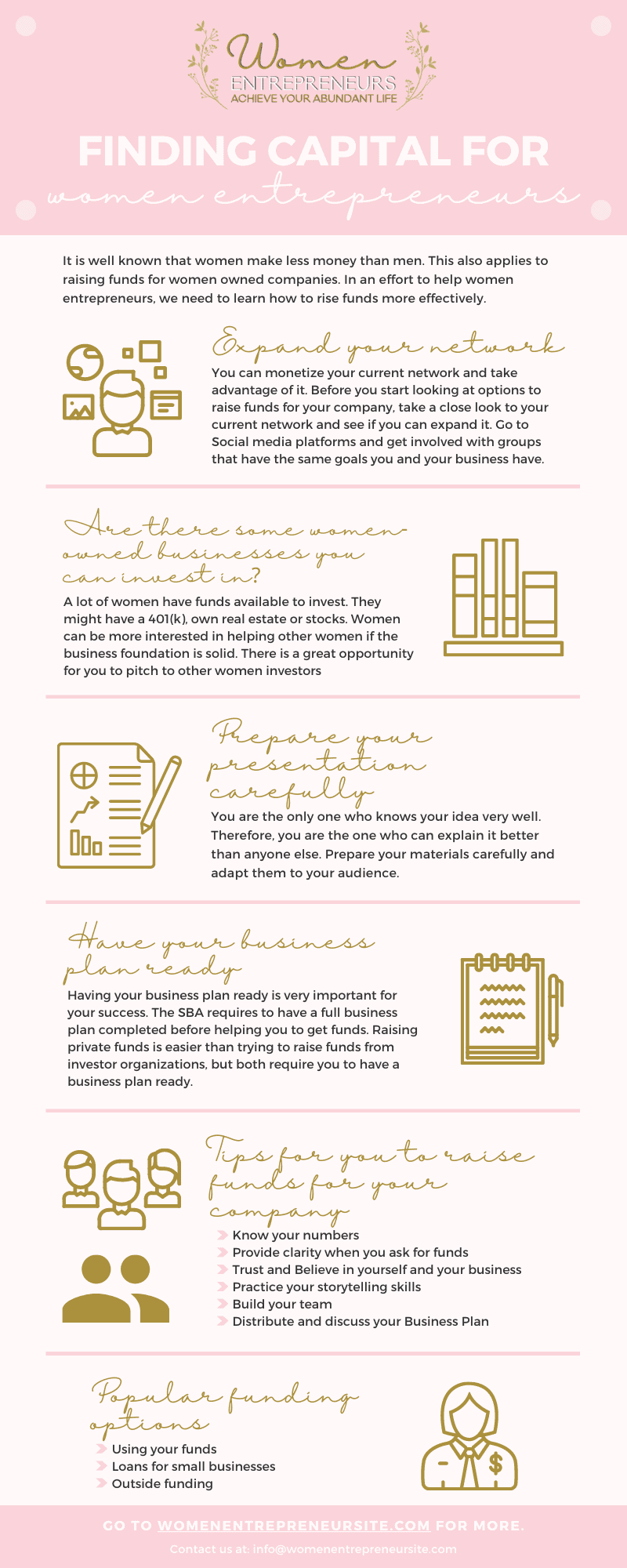

It is widely acknowledged that women earn less than men, and the same applies to raising funds for businesses owned by women. Female entrepreneurs often encounter various difficulties when it comes to finding funding options. Recent data suggests that men raise 79% of available business capital, while women only raise 2.2%, according to a Fortune magazine article. To support women entrepreneurs, it is crucial to identify effective methods for funding.

>> You may get information on this book from Amazon

To get rich, you must break these four rules

Expand your network

Growing your network is essential for both personal and professional development. The following are some suggestions on how to achieve this:

- Attend events related to your industry or interests, such as conferences, seminars, trade shows, and workshops.

- Use Social Media platforms like LinkedIn, Twitter, and Facebook can be powerful tools for networking.

- Join online groups and communities related to your interests or industry on platforms such as Facebook, LinkedIn, or Reddit.

- Volunteering for causes or organizations you care about is a great way to meet new people and build relationships while making a positive impact.

- Attend meetups relevant to your interests, meet new people, and build connections.

- Take the initiative to connect with people you admire or those who work in your industry. Don’t wait for others to reach out to you; instead, be proactive.

- After meeting new people, follow up with them to keep the conversation going. Send a thank-you note or email, ask for a follow-up meeting, or invite them to an event you think they might be interested in.

Keep in mind that establishing a network requires time and effort, but the benefits are substantial. Expanding your network enables you to gain fresh perspectives, learn from others, discover new prospects, and create enduring connections.

Are There Some Women-Owned Businesses You Can Invest In?

It is not uncommon for women to have available funds for investment purposes. It may be that they have a 401(k), own real estate, or own stocks. It is easier for women to help other women if the business foundation is solid. You have the opportunity to pitch to other women investors

Ensure That Your Presentation Is Well Prepared

Only you know your idea very well. As a result, you are the best person to explain this to others. Make sure your materials are prepared carefully and adapted to your audience’s needs.

You should practice your pitch until you are satisfied with the final presentation. You may be able to refine your sales presentation with the help of friends and family. Make sure to have a set of possible queries ready in advance!

Have Your Business Plan Ready

For your business to succeed, you must have a business plan in place. Before you can get funding from the SBA, you need to complete a full business plan. A business plan is required for both raising private funds and raising funds from investor organizations.

Here Are Some Tips for Raising Funds for Your Business

Keeping Track of Your Numbers

For new entrepreneurs, this is a major problem. Investors hesitate to ask specific questions when the time comes. Knowing and understanding your numbers is absolutely essential. Get intimate knowledge of your market and potential customers by practicing with family and friends.

When Asking for Funds, Be Clear

Make sure you know how much money you need and what you plan to do with it. Answer questions about your own investment in the business idea and your growth vision.

Your Business and Yourself Deserve Your Trust

Making a presentation with confidence is half the battle. Give an explanation of what you are capable of and how you understand your business numbers. An investor sees you as the business and the idea. You will be the main focus of their investment.

You need to convince them that you are the right person for the job, but also the only one who can make it happen!

Learn How to Tell a Story

It’s all about practice. Remember that investors will invest in what they understand. In order to succeed at this, you must clearly explain how you are solving a problem in the marketplace. How you plan to monetize this opportunity is also important.

Make Your Team Stronger

Ensure the right team with the right credentials is in place. Provide an explanation of how this is relevant to their business and how they will be able to help your company. Make sure your team is prepared to assist you with the presentation if they are going to help.

- You Should Distribute and Discuss Your Business Plan

- Describe how your business model will work.

- Your product or service should describe how it:

- Identify the problem you are solving for your customer

- Revenue potential and margin expectations.

- Do you have a growth strategy in place?

- Order timeframe expected

- Identify the final consumer and the value chain

- Risks and roadblocks

For your potential investors, it is important to be realistic and optimistic.

The Little Book of Common Sense Investing

The Little Book of Common Sense Investing is a timeless handbook on market intelligence. Famed mutual fund innovator John C. Bogle uncovers the secret to maximizing investments: utilizing low-cost index funds. Bogle elucidates the most uncomplicated and successful investment tactic for long-term wealth building: purchasing and holding a mutual fund that tracks a comprehensive stock market index, such as the S&P 500, at a significantly low expense.

Options for Funding

Using Your Own Fundings

Many entrepreneurs don’t like to be liable to others, so they use their own savings, credit lines, and sometimes their business credit cards. The first stages of the business are usually filled with this type of situation. Investing your own fundings first can be a requirement for some investors before they will lend you money.

Small Business Loans

If you own a small business, you may be able to apply for a bank loan or start with an SBA loan. In most cases, banks have good rates, and if you have good credit and paperwork (business plan), you may be able to obtain them easily. Your payments will be stable and predictable if you have a bank loan.

Outside Funding

Angel investor networks and funding investment companies exist. Your company’s industry will dictate how easy or difficult it is to work with them. As well as these options, there are online options like Kickstarter and iFundWomen which are called crowd funding platforms.