In the realm of professional growth, there comes a pivotal moment for many individuals when the…

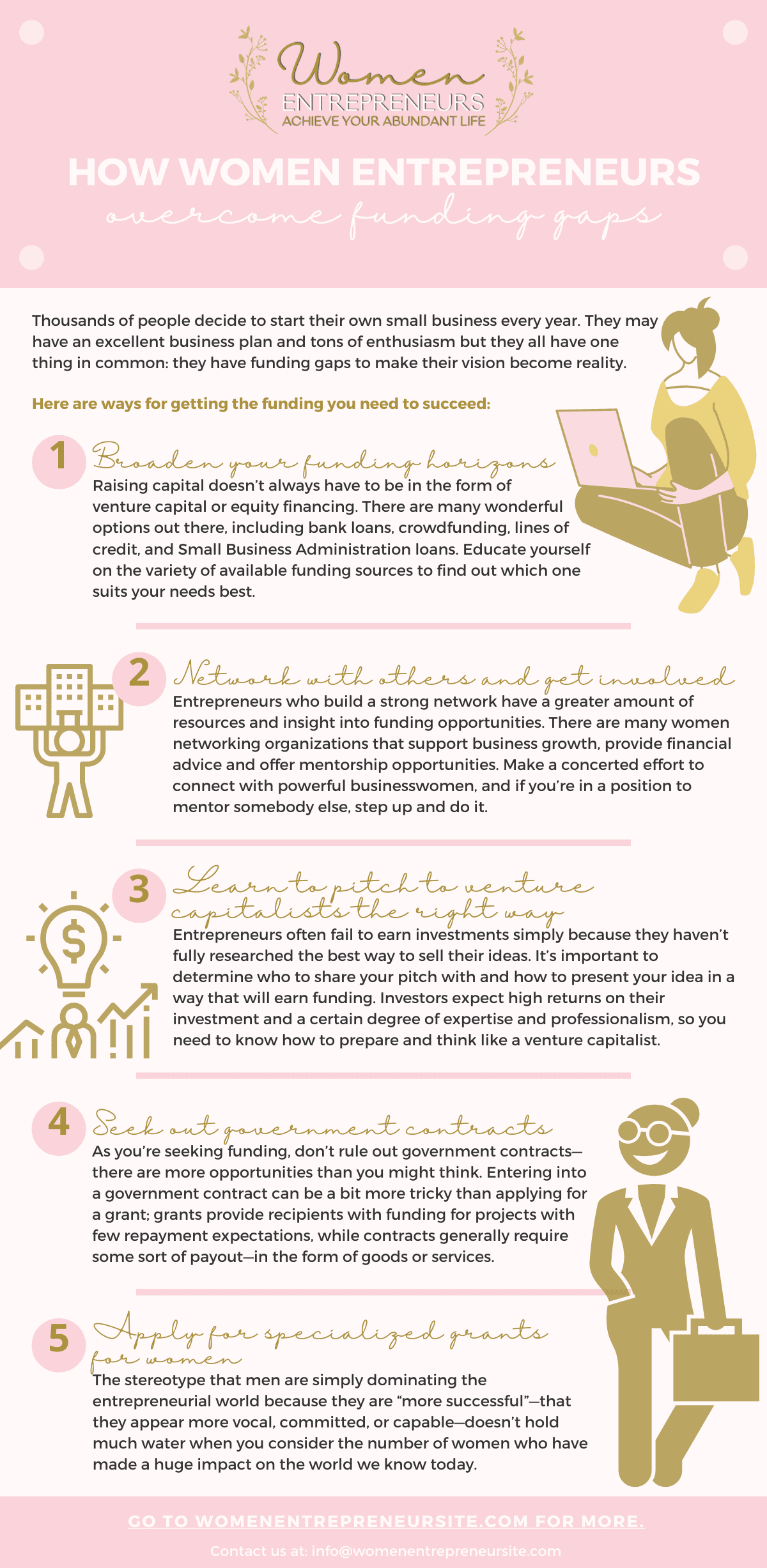

How Women Entrepreneurs Overcome Funding Gaps

Millions of individuals embark on the journey of establishing small businesses annually. Regardless of their exceptional business strategies and high levels of motivation, they share a common obstacle: insufficient funding that hinders the materialization of their aspirations.

Historically, women have been paid less than men, but finding funding for startups can be a challenge for female entrepreneurs. Due to the fact that male entrepreneurs currently dominate the market, women may find it harder to get start-up financing partly due to their mistaken belief that they are more trustworthy when it comes to generating dependable returns.

How to Raise a Venture Capital Fund

An overview is provided in this book. It examines the procedure of raising a financial backing fund, the how-tos, the unique language of the minimal companion (LP) globe, keys of exactly how LPs consider fund persistence and placement, best practices in fundraising, what works, and just how to be prepared.

The following methods can help you get the funding you need:

1. Broaden your funding horizons.

Equity capital and equity funding aren’t the only ways to raise resources. You can get a loan from a bank, through crowdfunding, through a line of credit, or even via Small Business Management loans. Find out which funding source best fits your requirements by researching the various funding options.

2. Join a network and get involved.

Entrepreneurs who build strong networks have access to more resources and an understanding of funding opportunities. There are many women networking companies that provide financial suggestions, mentorship opportunities, and service development. If you remain in a position to advise someone else, step up and do it. Reach out to effective businesswomen.

Business landscape changes can (and should) be advocated by individuals like you. Don’t forget to support other women and initiatives that advocate for women in business as you look for funding opportunities.

3. Get the right pitch to venture capitalists

Many business owners fail to make financial investments simply because they don’t fully research the best way to sell their suggestions. Establish who to share your pitch with, and also how to present your concept in a way that will gain funding. Venture capitalists expect high returns on their investments, as well as professionalism and reliability, so you need to think and prepare like one.

4. Seek out government contracts

When you’re seeking funding, don’t discount federal government agreements – there are more possibilities than you might think. Getting a government agreement can be a bit more difficult than getting a grant; grants provide recipients with funding for projects with few expectations of settlement, whereas agreements usually require some form of payment.

5. Women can apply for specialized grants

Taking into account the number of women who have made a significant contribution to the world we know today, the stereotype that guys are simply controlling the entrepreneurial world because they appear to be “a lot more effective” isn’t very convincing when you consider the fact that they are singing, committed, or qualified.

There are effective women entrepreneurs out there transforming their industries and also fulfilling demands that are usually overlooked, from inventing one of the earliest computer languages to establishing lasting feminine hygiene products.

Listed below are a few other specialized grants you might be interested in:

- The Eileen Fisher Women-Owned Business Grant: There are approximately ten recipients who receive grants between $12,000 and $120,000 under this program. In order to be eligible, businesses should have been in operation for at least three years, and their annual income can’t exceed $1 million.

- Amber Grant: An award of $500 is given to females in the military every month. Additionally, one additional $1,000 give is offered each year.

- Walmart’s Women’s Economic Empowerment Initiative: As part of its commitment to help women-owned small businesses, Walmart is promising to source $20 billion from them.

Clever Girl Finance

- Make your side hustle a success

- Invest in your future and build a nest egg

- Maintain a budget and monitor your expenses

- Organize your credit cards and keep your credit in check

- Spend your modest salary wisely and still have money left over

- Make yourself accountable for your financial wellbeing by changing your money mindset